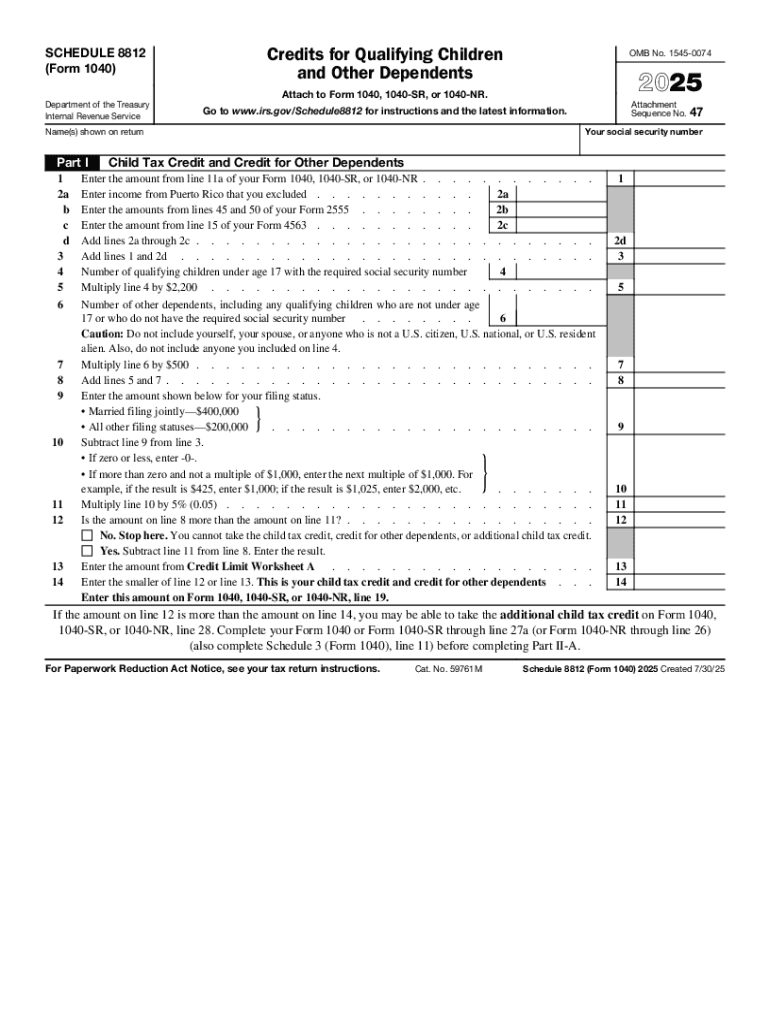

IRS 1040 - Schedule 8812 2025-2026 free printable template

Instructions and Help about IRS 1040 - Schedule 8812

How to edit IRS 1040 - Schedule 8812

How to fill out IRS 1040 - Schedule 8812

Latest updates to IRS 1040 - Schedule 8812

All You Need to Know About IRS 1040 - Schedule 8812

What is IRS 1040 - Schedule 8812?

Who needs the form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Components of the form

What information do you need when you file the form?

FAQ about IRS 1040 - Schedule 8812

What should I do if I need to amend my IRS 1040 - Schedule 8812 after submission?

If you discover an error after submitting your IRS 1040 - Schedule 8812, you should file an amended return using Form 1040-X. Be sure to follow the instructions carefully and include any necessary documentation to support changes. It’s advisable to keep a copy of both the original and amended forms for your records.

How can I track the status of my IRS 1040 - Schedule 8812 submission?

You can track the status of your IRS 1040 - Schedule 8812 by using the IRS 'Where’s My Refund?' tool or checking your e-filing software for status updates. Common e-file rejection codes can also provide insight into any issues; ensure you address them promptly to avoid delays.

What are common errors to avoid when filing IRS 1040 - Schedule 8812?

Some common errors include incorrect Social Security numbers, miscalculating credits, and failing to sign your tax return. Review your IRS 1040 - Schedule 8812 carefully before submission to ensure all information is accurate and consistent to prevent any filing issues.

Are e-signatures acceptable for IRS 1040 - Schedule 8812?

Yes, e-signatures are acceptable for IRS 1040 - Schedule 8812 when filed electronically. Ensure that you follow the specific e-signature guidelines provided by the IRS to maintain compliance and validity of your submission.

See what our users say